SparkReceipt Review – Introduction

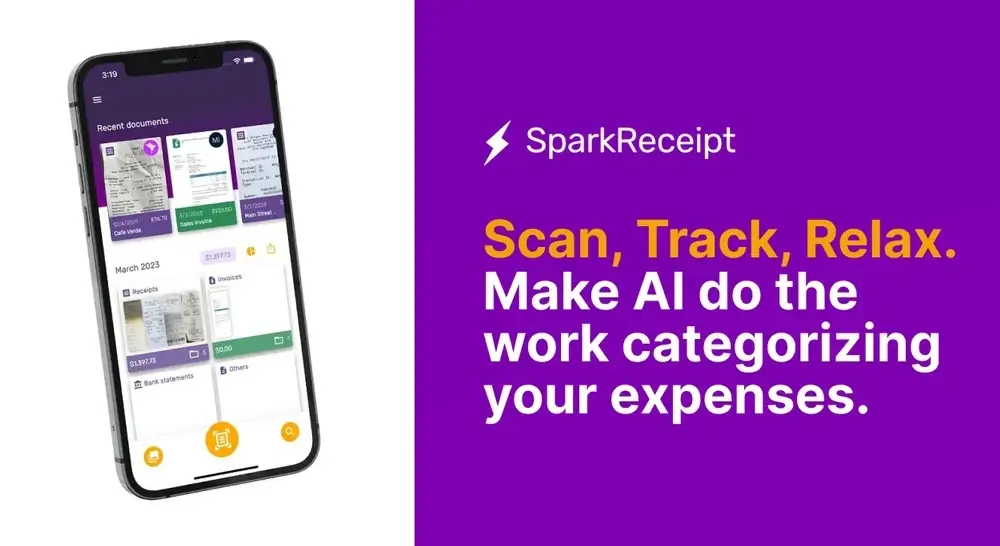

I’m writing this SparkReceipt review post because this powerful app makes receipts and expenses management a walk-in-the-park compared to its counterparts. For small businesses and freelancers, it’s time-consuming to manage receipts, expenses, or financial documents. However, with SparkReceipt it becomes seamless and automated. This AI-powered app is an excellent application for freelancers and small business owners, which processes everything from scanning receipts to categorizing expenses. This post takes us through the features of SparkReceipt, How it works, and the benefits of its use. We also discuss everything you need to know about this powerful tool for expense management.

SparkReceipt Review – What Is SparkReceipt?

SparkReceipt is a sophisticated expense and receipt tracking app intended for freelancers and small businesses. This powerful tool combines Optical Character Recognition (OCR), and artificial intelligence to digitize receipts and bring them to your fingertips. SparkReceipt allows you to scan receipts, track your expenses & generate financial reports with ease. The app works on mobile devices and the web, so whoever needs to manage finances on the go or their computers has the app available to him.

SparkReceipt Review – Features

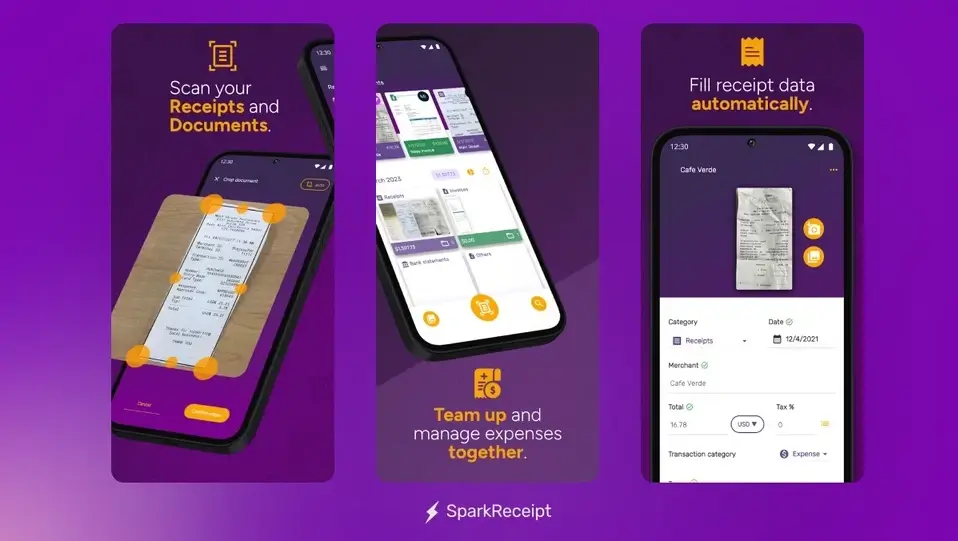

Simplify Expense Tracking

- Receive invoices, scan payments and receipts, and other documents.

- Use AI-driven technology to let your expenses categorize themselves automatically.

- Instead, compile all your financial documents into one place you can refer to easily.

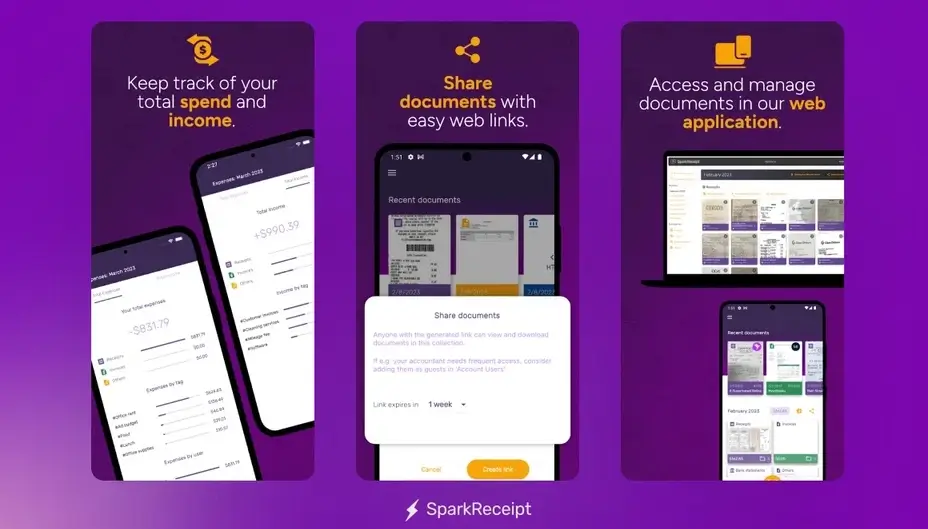

Collaborate with Ease

- Get access to receipts and invoices in real time via the web app.

- Access and edit files in shared groups, with no one out of sync.

Stay on Top of Your Finances

- Keep real-time data with your spending and income.

- Spend less time generating financial reports for decision-making.

- Streamline processing of accounting processes, Integrating with other financial tools

SparkReceipt Review – How Does It Work?

- Scan Receipts: Then users either scan receipts using their smartphone camera or upload digital copies. The app’s AI scans and pulls specific information through then stores it in the cloud.

- Automatic Categorization: SparkReceipt will automatically organize each receipt by category (e.g. travel, office supplies). There are also categories in case the users need to adjust.

- Manage Receipts and Expenses: All receipts can be seen on the user’s account and can be modified, shared, or edited. Users can also add notes or tags so receipts can be more organized.

- Generate Reports: Users can then generate financial reports in different formats and can easily review their expenses for review and prepare documents for tax purposes or financial planning.

SparkReceipt Review – Benefits For You

- Time-Saving: With SparkReceipt, we automate the scanning and categorization of receipts, freeing time and effort spent on manual data entry.

- Enhanced Accuracy: AI technology makes sure that essential data are captured correctly to minimize human error when entering it.

- Accessibility: Users are also able to access their receipts and financial data wherever they are from a mobile device or web app through Cloud Storage.

- Expense Tracking: One of the app’s capabilities is to classify and report the payment to ensure that a user is aware of what he or she has spent. This makes one able to make informed financial decisions.

- Improved Organization: SparkReceipt frees users from physical clutter by keeping receipts in one digital space so they are easily accessible when required.

SparkReceipt Review – Who Should Use it?

- Freelancers: Those of us who are independent workers and need an easy way to track our expenses and stay organized for tax purposes.

- Small Business Owners: Business owners who want to simplify expense management and document organization, without investing in costly accounting software.

- Teams: For small teams that want a platform to share and track expenses and collaborate on financial management.

- Personal Finance Enthusiasts: As an easy way for individuals or couples to keep and classify personal expenses.

SparkReceipt Review – What’s In It For You?

- Unlimited Receipt Scans: Unlimited scanning at AI accuracy, and receipt tracking is a breeze.

- Team Collaboration: Grant team members or a go-getting accountant to manage expenses better and keep an eye on the financial side of things.

- Document Organization: Financial records can be kept in an organized spot where you don’t have to manually file.

- Influence on Future Features: The fact that AppSumo users can choose to contribute features isn’t unique but that is also one of the things that make the AppSumo community unique.

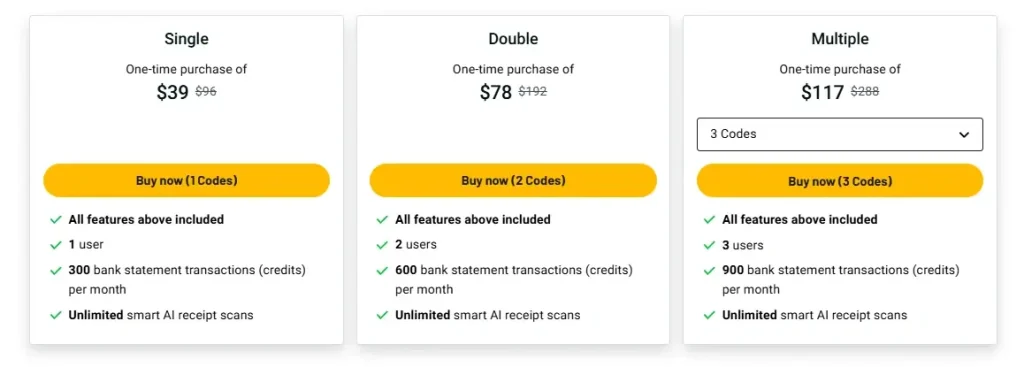

SparkReceipt Review – Pricing

- Single Plan – $39: It includes one user, 300 monthly bank statement credits, and unlimited receipt scans.

- Double Plan – $78: It provides access to two users, 600 a-month credits, and unlimited scans.

- Multiple Plan – $117: This plan was designed for teams, it can support three users, 900 monthly credits, and unlimited scans.

SparkReceipt Review – Pros and Cons

Pros:

- AI and OCR technology and efficient receipt scanning

- For convenient access to the data from any device store data in cloud storage.

- Lifetime access, multiple pricing options

- Collaboration tools for teams

- Popular accounting software integrations

Cons:

- Available only for freelancers and small business use cases

- For large businesses, credits for bank transactions may need added codes.

- It doesn’t have some of the more sophisticated accounting options either.

SparkReceipt Review – About the Founder

Antti Laitinen, a former freelance software developer, created the app because he had to. Antti worked as an international receipts manager and digital invoice and any other expenses-related documents manager, and then, he built SparkReceipt to tackle his problems there. This tool is now available for freelancers and small business owners who want a streamlined way to do their financial management.

SparkReceipt Review – FAQ

Q: Is SparkReceipt suitable for medical receipts or secure data?

A: SparkReceipt has support on a variety of receipt types but it is a good idea to consult with Spark Receipt’s support team regarding how sensitive medical data is handled.

Q: Can I import existing data into SparkReceipt?

A: Yes, you can import past expenses CSV files to be added to the platform.

Q: Can SparkReceipt handle handwritten documents?

A: Unless your handwriting is legible and follows a similar direction format, SparkReceipt’s OCR may recognize it, but printed documents are much preferred.

Q: Are bank statement credits stackable?

A: Absolutely, adding extra codes boosts the monthly bank statement credits and is therefore scaleable to larger volume businesses.

Q: Is there a free trial available?

A: Users can sign up with a free plan for SparkReceipt which allows you up to 30 scans a month and includes the key features any individual user would need.

SparkReceipt Review – Conclusion

In conclusion, SparkReceipt is an AI-driven expense management solution for freelancers and small businesses looking for a way to properly manage expenses without all the complexity of traditional accounting software. SparkReceipt has all the essentials from the collaborative features, and cloud storage to scanning and categorizing receipts into the pocket version. Being a member of AppSumo lifetime access to all of its offerings for a fraction of its normal price to users who can save time, reduce administrative burdens, and stay on top of their finances. SparkReceipt is a straightforward tool for modern financial management for the freelancer or business owner.

Thank you for reading my SparkReceipt Review to the end. It will help you make the perfect purchase decision.

Check Out My Previous Reviews: Pismo Review, Ranklytics Review, Insertchat Review, PDF-API.io Review, Kroto Review, SparkReceipt Review, VideoToPage Review